Investor Presentation i n c o r p o r a t e d NASDAQ: ALCO www.alicoinc.com May 2024

Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements regarding our expectations related to box production and citrus pricing, the potential value of our land holdings, our long term debt targets, our ESG initiatives, for future operations or any other statements relating to our future activities or other future events or conditions. These statements are based on our current expectations, estimates and projections about our business and assets based, in part, on assumptions made by our management and can be identified by terms such as “will,” “should,” “expects,” “plans,” ,”hopes,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “forecasts,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including, but not limited to: adverse weather conditions, natural disasters and other natural conditions, including the effects of climate change and hurricanes and tropical storms, particularly because our citrus groves are geographically concentrated in Florida; damage and loss from disease including, but not limited to, citrus greening and citrus canker; any adverse event affecting our citrus business; our ability to effectively perform grove management services, or to effectively manage an expanded portfolio of groves; our dependency on our relationship with Tropicana and Tropicana’s relationship with certain third parties for a significant portion of our business; our ability to execute our strategic growth initiatives and whether they adequately address the challenges or opportunities we face; product contamination and product liability claims; water use regulations restricting our access to water; changes in immigration laws; harm to our reputation; tax risks associated a Section 1031 Exchange; risks associated with the undertaking of one or more significant corporate transactions; the seasonality of our citrus business; fluctuations in our earnings due to market supply and prices and demand for our products; climate change, or legal, regulatory, or market measures to address climate change; ESG issues, including those related to climate change and sustainability; increases in labor, personnel and benefits costs; increases in commodity or raw product costs, such as fuel and chemical costs; transportation risks; any change or the classification or valuation methods employed by county property appraisers related to our real estate taxes; liability for the use of fertilizers, pesticides, herbicides and other potentially hazardous substances; compliance with applicable environmental laws; loss of key employees; material weaknesses and other control deficiencies relating to our internal control over financial reporting ; macroeconomic conditions, such as rising inflation, the deadly conflicts in Ukraine and Israel, and the COVID-19 pandemic; system security risks, data protection breaches, cyber-attacks and systems integration issues; our indebtedness and ability to generate sufficient cash flow to service our debt obligations; higher interest expenses as a result of variable rates of interest for our debt; our ability to continue to pay cash dividends; and the other factors described under the sections "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in. our Annual Report on Form 10-K for the fiscal year ended September 30, 2023 filed with the Securities and Exchange Commission (the “SEC”) on December 6, 2023, and in our Quarterly Reports on Form 10-Q, to be filed with the SEC. Past performance is not necessarily indicative of future results. Except as required by law, we do not undertake an obligation to publicly update or revise any forward-looking statement in this presentation, whether as a result of new information, future developments, or otherwise. This presentation also contains financial projections that are necessarily based upon a variety of estimates and assumptions which may not be realized and are inherently subject, in addition to the risks identified in the forward-looking statement disclaimer, to business, economic, competitive, industry, regulatory, market and financial uncertainties, many of which are beyond the Company’s control. There can be no assurance that the assumptions made in preparing the financial projections will prove accurate. Accordingly, actual results may differ materially from the financial projections. Non-GAAP Financial Measures: In addition to the GAAP financial measures, Alico utilizes EBITDA which is a non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K, to evaluate the performance of its business. Due to significant depreciable assets associated with the nature of our operations and, to a lesser extent, interest costs associated with our capital structure, management believes that EBITDA is an important measures to evaluate our results of operations between periods on a more comparable basis and to help investors analyze underlying trends in our business, evaluate the performance of our business both on an absolute basis and relative to our peers and the broader market, provide useful information to both management and investors by excluding certain items that may not be indicative of our core operating results and operational strength of our business. Such measurement is not prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) and should not be construed as an alternative to reported results determined in accordance with U.S. GAAP. The non-GAAP information provided is unique to Alico and may not be consistent with methodologies used by other companies. EBITDA is defined as net income before interest expense, provision for income taxes, depreciation, depletion and amortization. See the Appendix to the presentation for a reconciliation of EBITDA to loss for the period, the most directly comparable financial measure calculated and presented in accordance with GAAP, for the periods presented.

Our History Alico Inc. is a Florida-based agribusiness and land management company with 125 years of experience. Alico owns approximately 54,500 acres of land and approximately 49,500 acres of oil, gas, & mineral rights in whole or part throughout Florida. Our main operations are citrus production and land management, including citrus cultivation, management of citrus groves for third parties, and leases for grazing, farming, and mining. Alico seeks to provide investors with the benefits and stability of a conventional agriculture investment with the optionality that comes with active land management.

Achieving Goals monitor finances Alico currently manages approximately 49,000 acres of citrus groves in 31 locations across 7 counties. Alico is a major landowner; its primary asset is 54,500 acres of land. Top citrus grower in the US and primary supplier to Tropicana, a leading orange juice brand in the US. Recognized within the citrus industry for exceptional caretaking practices, one result being a new partnership with a large citrus grower to manage another 3,300 acres of citrus groves, with expenses reimbursed and a management fee paid per acre for its services. Alico’s Largest Asset: Our Land Source: Alico earnings press release years-end September 30, 2023, 2022, 2021, 2020, 2019, 2018 and 2017.

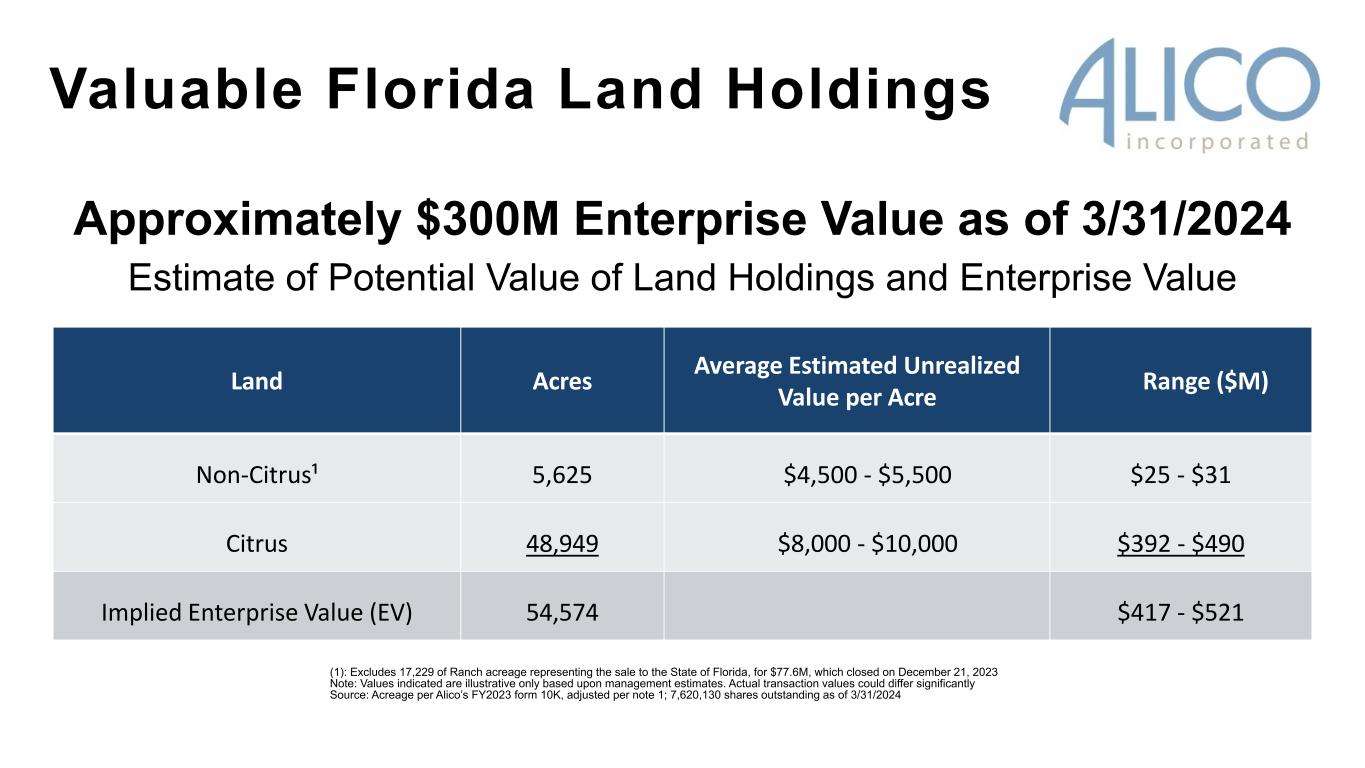

Valuable Florida Land Holdings Approximately $300M Enterprise Value as of 3/31/2024 Estimate of Potential Value of Land Holdings and Enterprise Value (1): Excludes 17,229 of Ranch acreage representing the sale to the State of Florida, for $77.6M, which closed on December 21, 2023 Note: Values indicated are illustrative only based upon management estimates. Actual transaction values could differ significantly Source: Acreage per Alico’s FY2023 form 10K, adjusted per note 1; 7,620,130 shares outstanding as of 3/31/2024 Land Acres Average Estimated Unrealized Value per Acre Range ($M) Non-Citrus¹ 5,625 $4,500 - $5,500 $25 - $31 Citrus 48,949 $8,000 - $10,000 $392 - $490 Implied Enterprise Value (EV) 54,574 $417 - $521

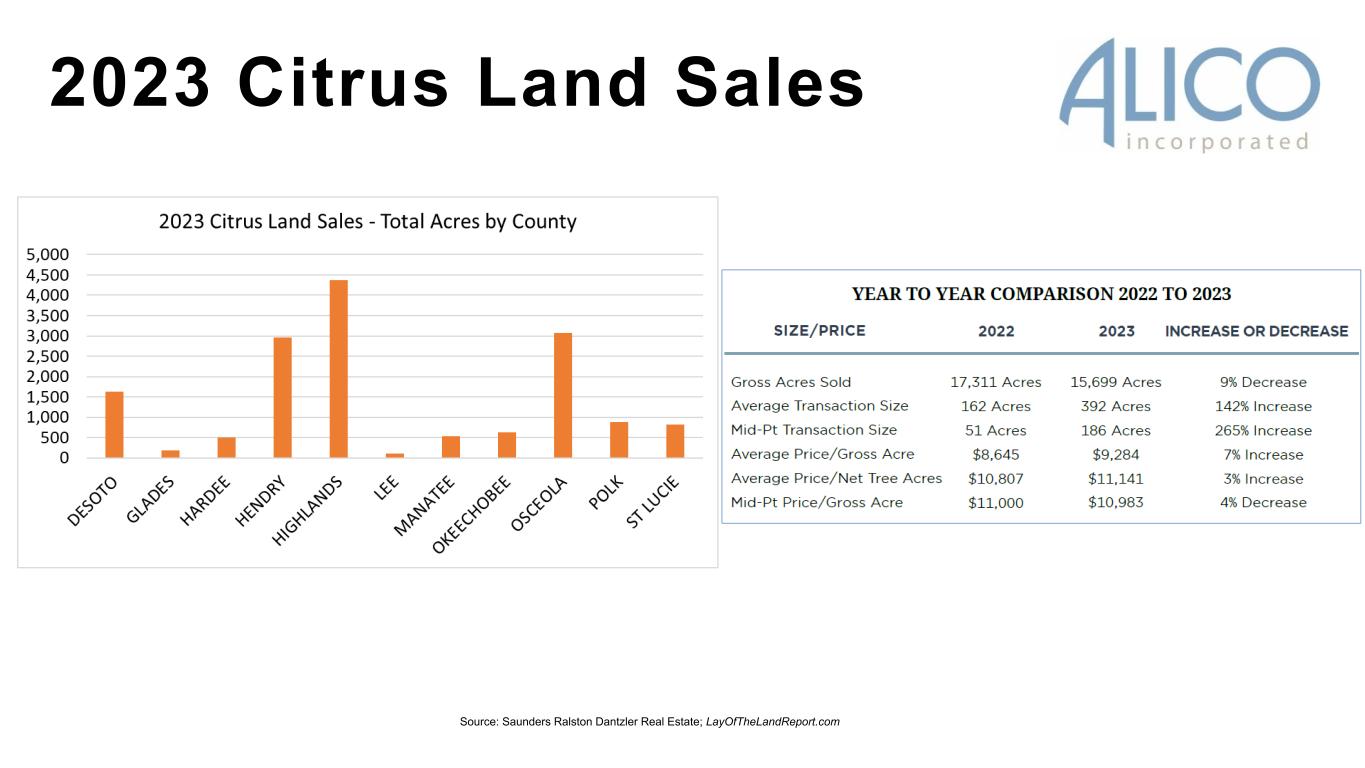

2023 Citrus Land Sales Source: Saunders Ralston Dantzler Real Estate; LayOfTheLandReport.com

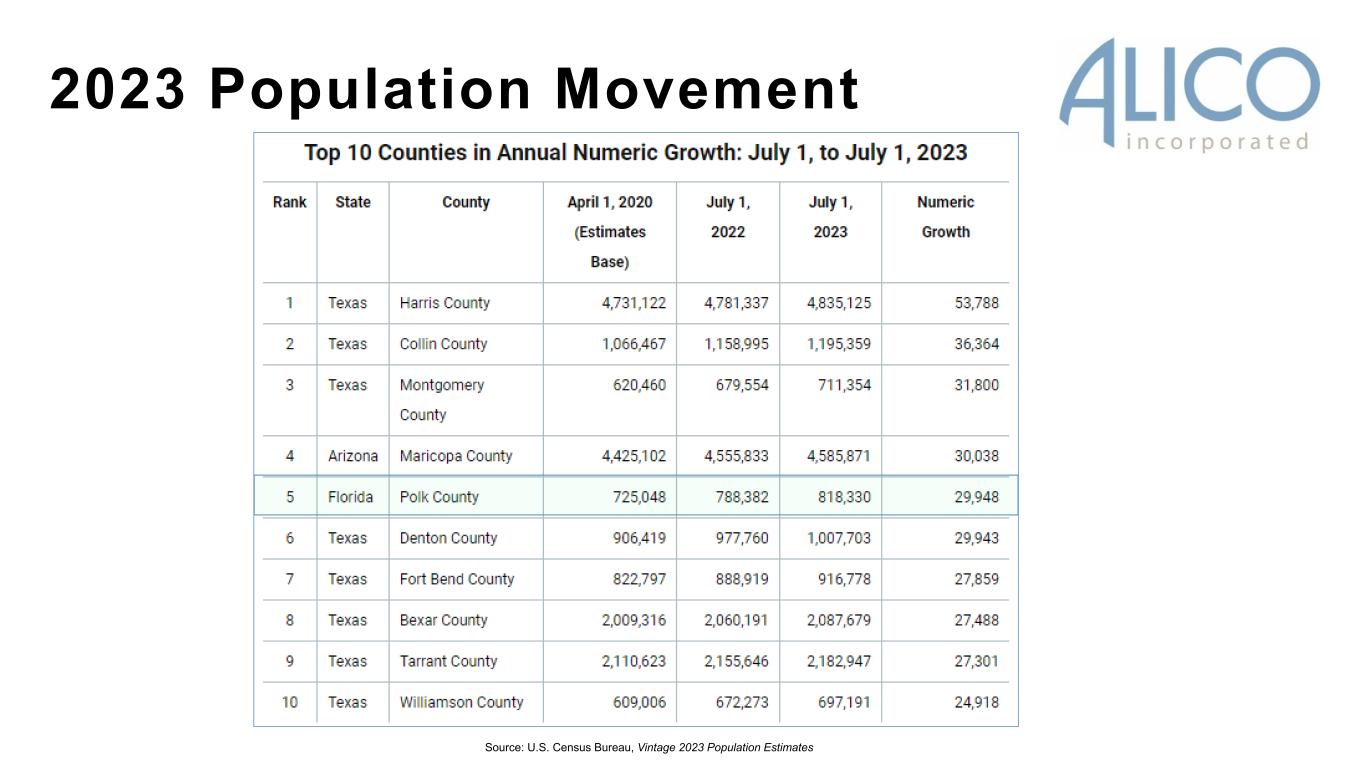

2023 Population Movement Source: U.S. Census Bureau, Vintage 2023 Population Estimates

On December 21, 2023, Alico sold to the State of Florida its remaining 17,229 acres of the Alico Ranch for approximately $77.6 million in gross proceeds. Approximately 69,000 acres of the Alico Ranch were sold for $226 million to more than 25 buyers since 2018. Recent Transactions

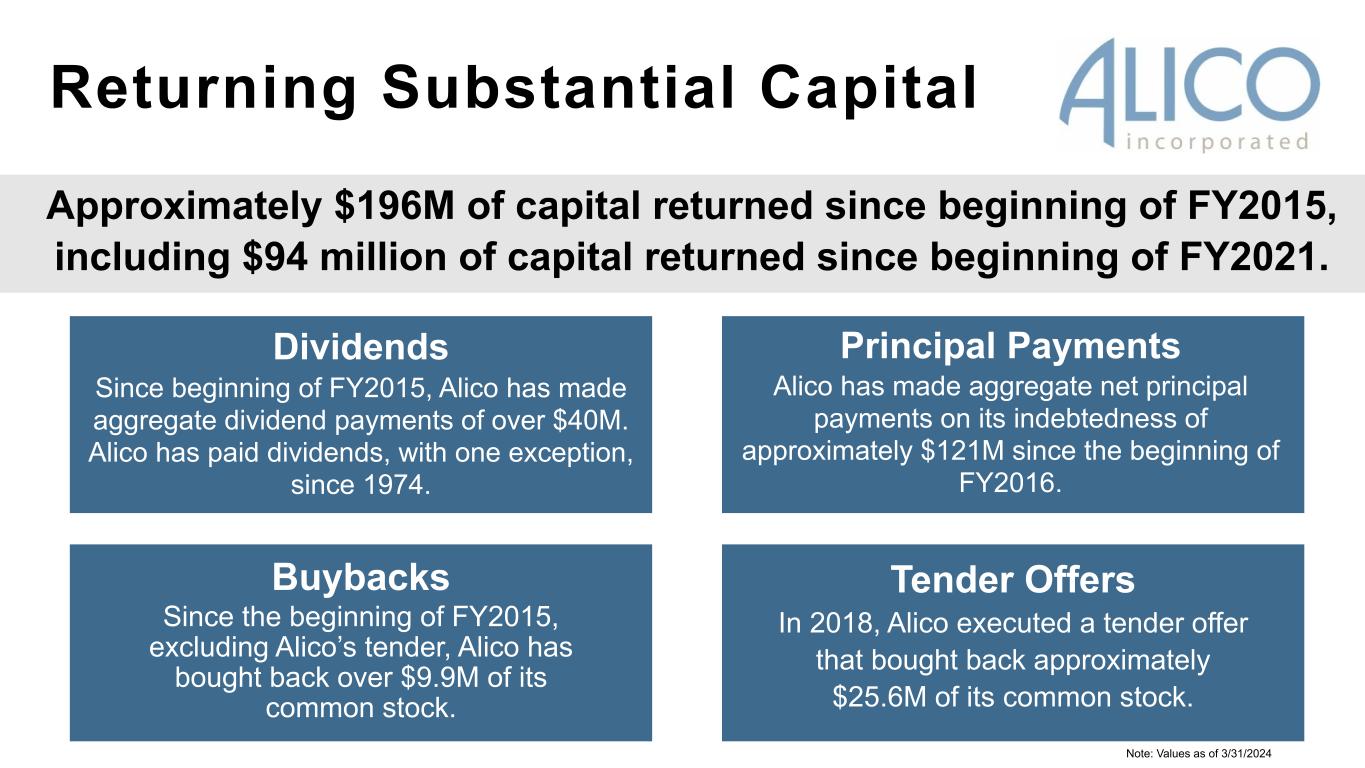

Dividends Since beginning of FY2015, Alico has made aggregate dividend payments of over $40M. Alico has paid dividends, with one exception, since 1974. Approximately $196M of capital returned since beginning of FY2015, including $94 million of capital returned since beginning of FY2021. Tender Offers In 2018, Alico executed a tender offer that bought back approximately $25.6M of its common stock. Buybacks Since the beginning of FY2015, excluding Alico’s tender, Alico has bought back over $9.9M of its common stock. Principal Payments Alico has made aggregate net principal payments on its indebtedness of approximately $121M since the beginning of FY2016. Note: Values as of 3/31/2024 Returning Substantial Capital

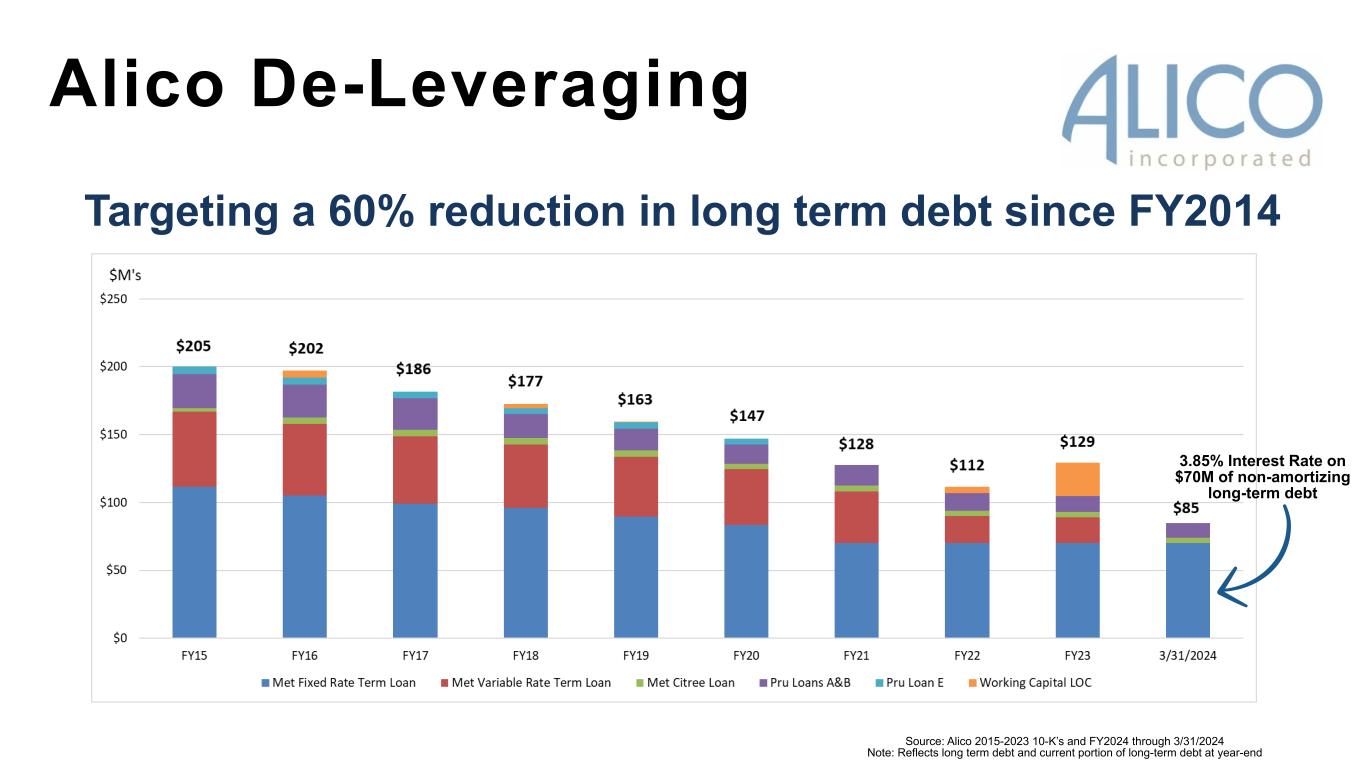

Targeting a 60% reduction in long term debt since FY2014 Source: Alico 2015-2023 10-K’s and FY2024 through 3/31/2024 Note: Reflects long term debt and current portion of long-term debt at year-end 3.85% Interest Rate on $70M of non-amortizing long-term debt Alico De-Leveraging

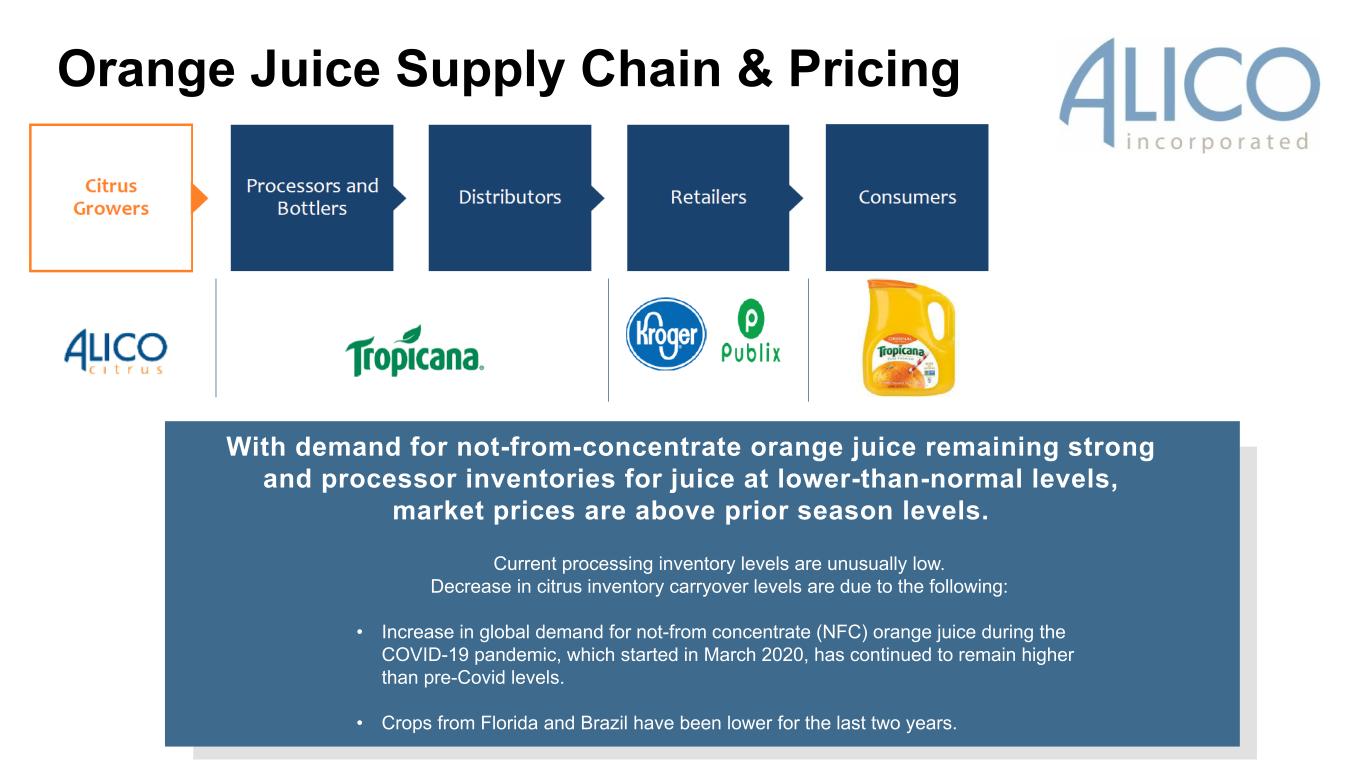

Orange Juice Supply Chain & Pricing With demand for not-from-concentrate orange juice remaining strong and processor inventories for juice at lower-than-normal levels, market prices are above prior season levels. Current processing inventory levels are unusually low. Decrease in citrus inventory carryover levels are due to the following: • Increase in global demand for not-from concentrate (NFC) orange juice during the COVID-19 pandemic, which started in March 2020, has continued to remain higher than pre-Covid levels. • Crops from Florida and Brazil have been lower for the last two years.

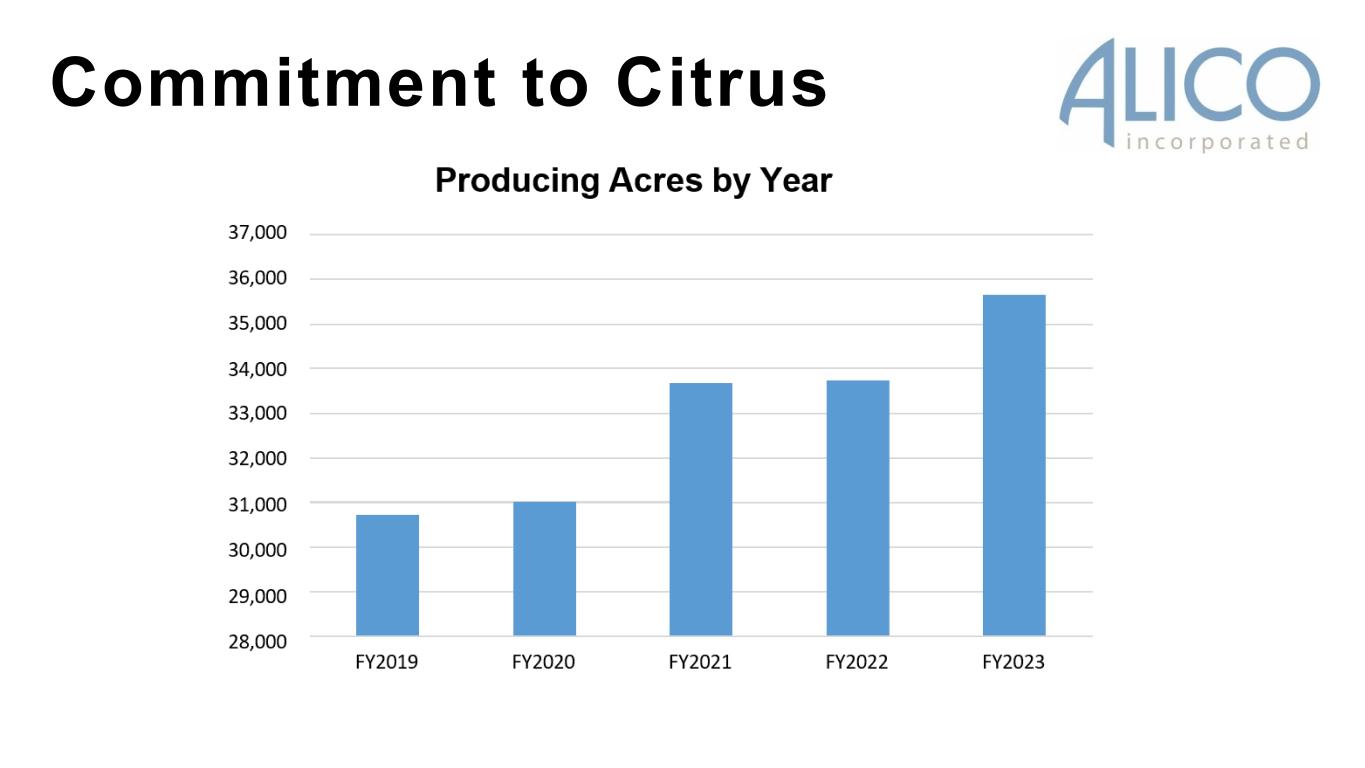

Commitment to Citrus

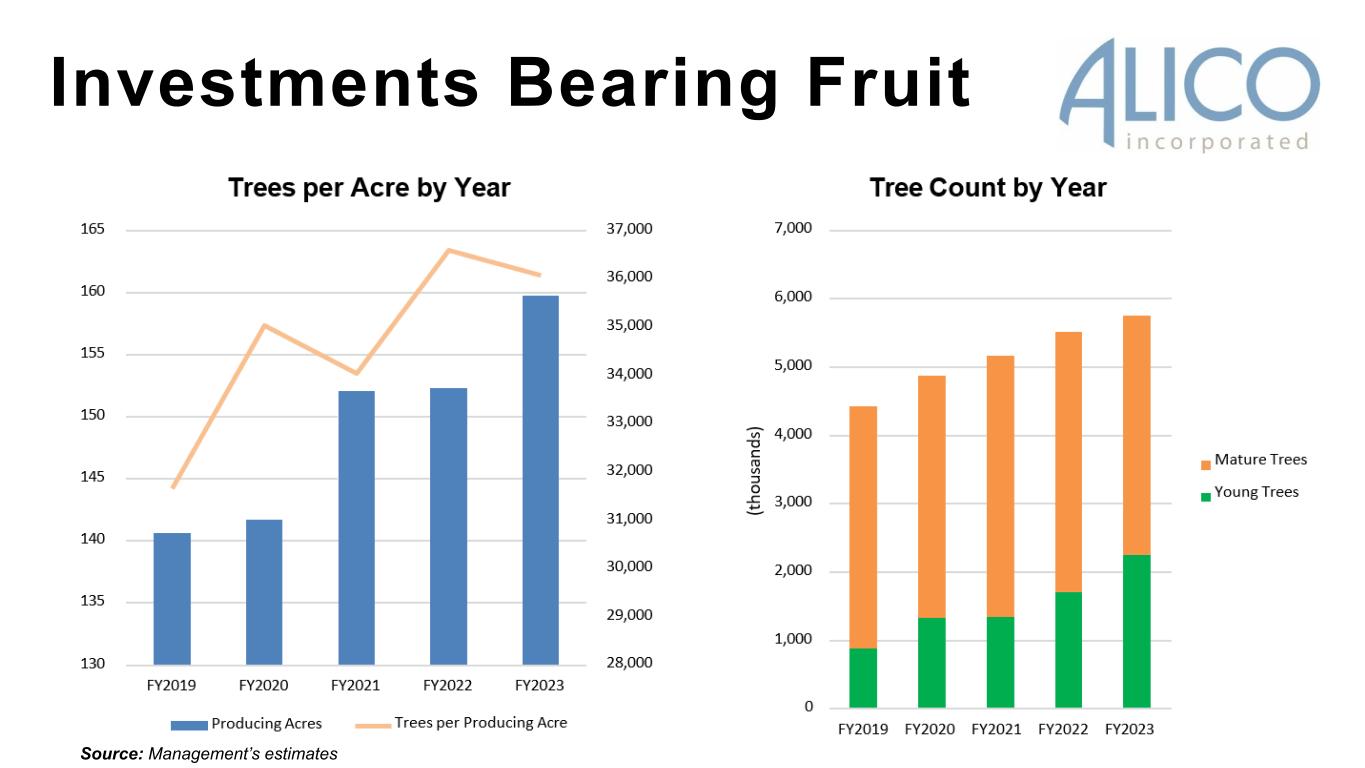

Citrus Leadership Increased tree plantings expected to result in improved production – potential for significant increased box production on existing acres as the 2.2 million trees planted reach full maturity. In fall of 2023, Alico added a new partnership with a large citrus grower to manage another 3,300 acres of citrus groves, with expenses reimbursed and a management fee paid per acre for its services. Alico will continue to pursue caretaking management services which provides for risk-free financial improvements. We expect to maintain cash growing costs at consistent levels over the next several years after factoring in minimum wage increases.

Investments Bearing Fruit Source: Management’s estimates

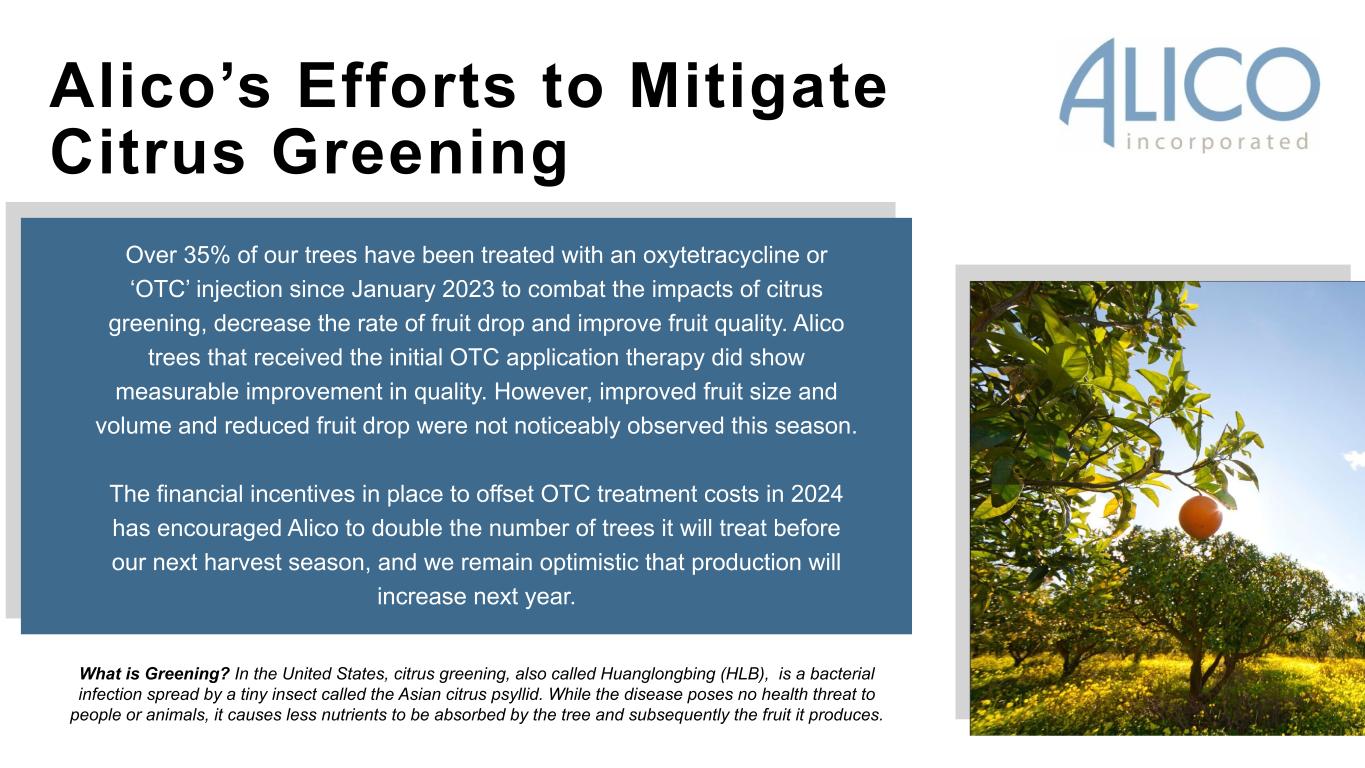

Alico’s Efforts to Mitigate Citrus Greening Over 35% of our trees have been treated with an oxytetracycline or ‘OTC’ injection since January 2023 to combat the impacts of citrus greening, decrease the rate of fruit drop and improve fruit quality. Alico trees that received the initial OTC application therapy did show measurable improvement in quality. However, improved fruit size and volume and reduced fruit drop were not noticeably observed this season. The financial incentives in place to offset OTC treatment costs in 2024 has encouraged Alico to double the number of trees it will treat before our next harvest season, and we remain optimistic that production will increase next year. What is Greening? In the United States, citrus greening, also called Huanglongbing (HLB), is a bacterial infection spread by a tiny insect called the Asian citrus psyllid. While the disease poses no health threat to people or animals, it causes less nutrients to be absorbed by the tree and subsequently the fruit it produces.

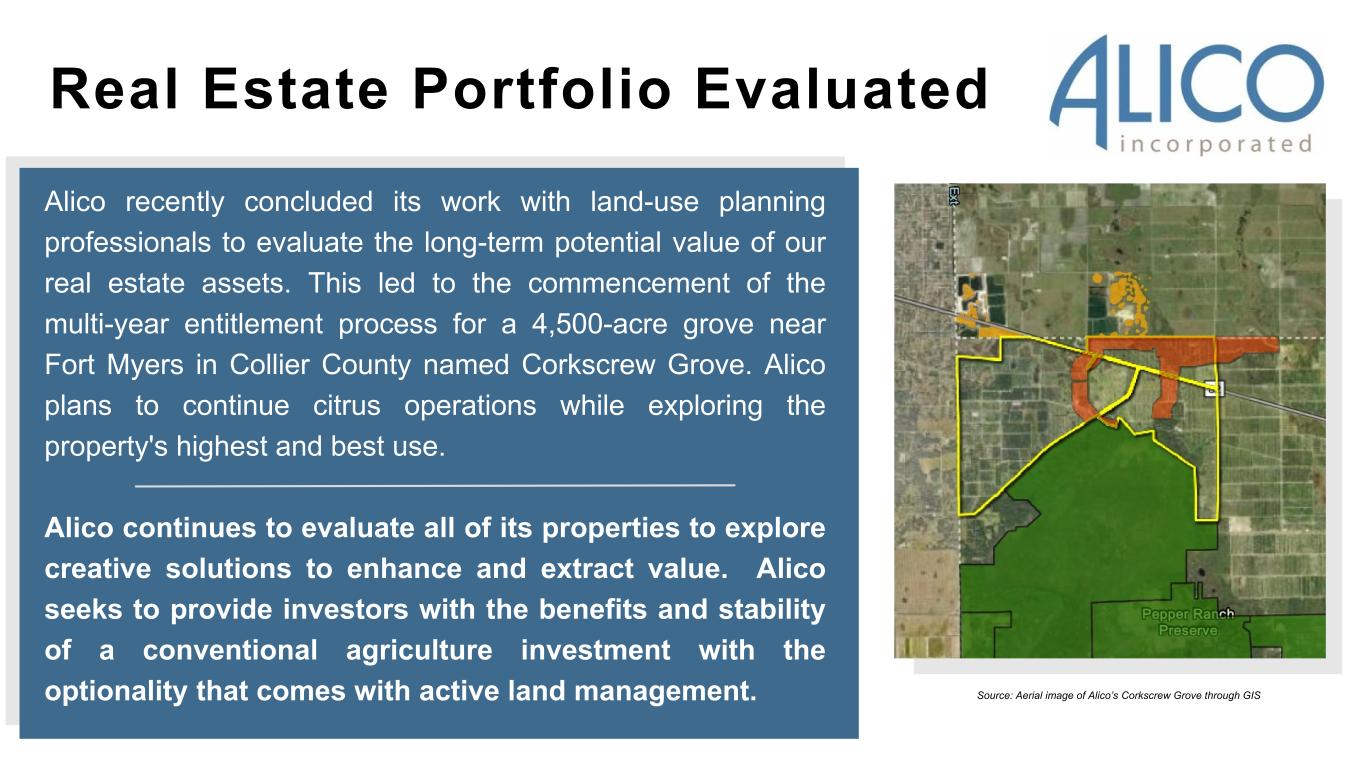

Alico recently concluded its work with land-use planning professionals to evaluate the long-term potential value of our real estate assets. This led to the commencement of the multi-year entitlement process for a 4,500-acre grove near Fort Myers in Collier County named Corkscrew Grove. Alico plans to continue citrus operations while exploring the property's highest and best use. Alico continues to evaluate all of its properties to explore creative solutions to enhance and extract value. Alico seeks to provide investors with the benefits and stability of a conventional agriculture investment with the optionality that comes with active land management. Real Estate Portfolio Evaluated Source: Aerial image of Alico’s Corkscrew Grove through GIS

Consistent with what we communicated in our inaugural Sustainability Report in 2021, over the past year Alico has worked to deliver on our ESG promises. Some of our notable accomplishments include: Visit our website for more information: www.alicoinc.com/sustainability Alico’s Environmental, Social, Governance (ESG) Initiatives • Continuing trials for slow-release fertilizer, which have potential to significantly reduce our carbon footprint over the long-term. • Providing human rights training to all employees, reinforcing our commitment to labor and human rights in our operations and across our value chain. • Continuing the Alico Women’s Council and Alico Hispanic Council Committees; business resource groups dedicated to supporting our female and our Hispanic and Latino employees. • Reinstituting (after a two-year COVID-19 delay) the requirement for all harvesting crew leaders to complete a Farm Management Certification Program, which provides an extra layer of assurance on food safety and workplace safety practices. • Continuing our membership in the United Nations Global Compact (UNGC) and aligning our sustainability efforts with the United Nations Sustainable Development Goals (UNSDGs) for Zero Hunger, Decent Work and Economic Growth, and Life on Land. ESG Initiatives Alico has been around for generations, and we are continuing to increase our sustainability value for the many years to come. As a frontrunner in the citrus industry, we are continuing to focus on being a responsible corporate citizen. We operate with integrity, protect our lands, cultivate the safety and skills of our people, and support our communities.

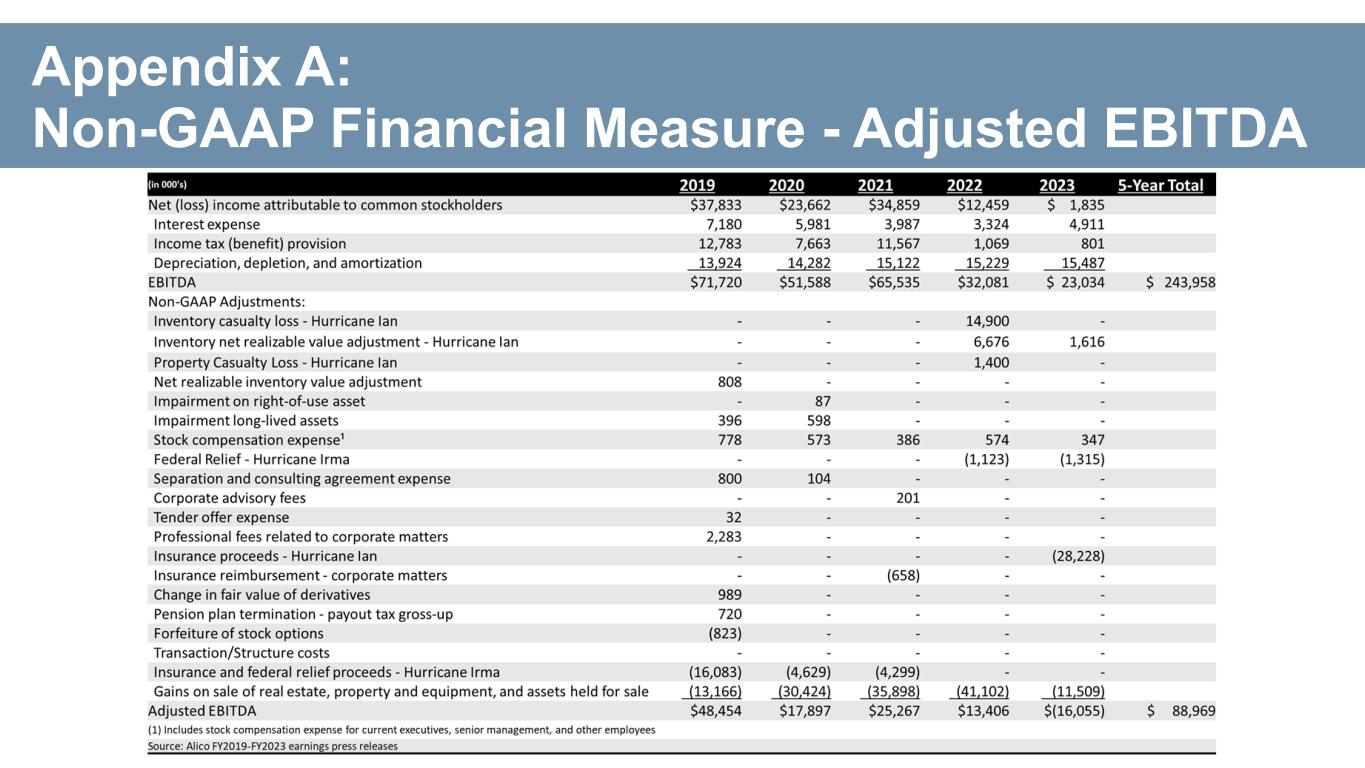

Maintain Industry Leadership • Nurture Tropicana relationship for long-term mutual benefits • Multi-year supply contracts • Aim to market fruit annually through owned or operated groves • Maintain strong relationships with all processors 125+ Year Old Leader Committed to Citrus for Generations to Come Investing for Growth • Maximize grove density and replant trees at maintenance levels elsewhere • Pilot alternative crops (hemp, bamboo, pongamia, etc.) • Expand Third-Party Caretaking Revenues • Technology enhancements $196M of Capital Returned Since Beginning of 2015 Cash f low invested or returned: • Debt repayments • Tender offer and share buybacks • Quarterly dividend payer since 1974. Financial Performance • $244 million of EBITDA* past 5-years • Pricing improving • Production potential to increase as trees mature • Expense Base Substantially Fixed • Ample liquidity Capital Markets • Sell-Side Research through Roth Capital • Strong institut ional ownership • Trading mult iples are lower than selected comparables Real Estate Strategy • Sold approximately 69,000 acres of Alico Ranch to over 25 buyers for approximately $226 million in gross proceeds. • Continue to pursue other strategic land purchases or sale opportunities • Monetize mineral rights • Evaluate Entitlement Alico is a n Ame rica n le ga cy... built for toda y's world. Why Invest in Alico? (1) EBITDA is a non-GAAP measure . See Appendix A in this presenta tion for reconcilia tion to the neares t GAAP measure . Note: Values as of 3/31/2024

Appendix A

Appendix A: Non-GAAP Financial Measure - Adjusted EBITDA

2024 Conference Schedule

John Kiernan Chief Executive Office r & Pres ident Brad Heine Chief Financia l Office r Lydia Gavner Chief of S ta ff Key Company Leadership (239) 226-2032 jkiernan@alicoinc.com (239) 226-2025 bheine@alicoinc.com (239) 961-5032 lgavner@alicoinc.com

For More Information investorrelations@alicoinc.com www.alicoinc.com www.linkedin.com/company/alico-inc. www.facebook.com/AlicoInc Fort Myers, Florida (239) 226-2000 Scan to view our interactive map Alico is an American legacy... built for today's world.